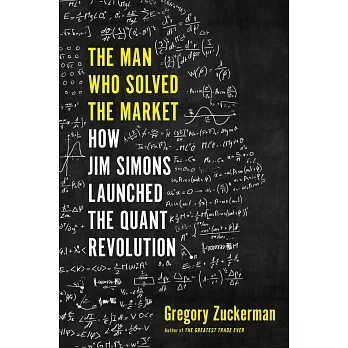

【2019金融時報與商業書大獎─決選入圍】

身價達200億美金 股神巴菲特都望塵莫及

金融界傳奇人物,顛覆華爾街的數學家詹姆斯.西蒙斯

致富祕辛與人生起落 由資深華爾街調查記者古格里.佐克曼Gregory Zuckerman告訴你

無庸置疑,詹姆斯.西蒙斯James (Jim) Simons可以說是當代致富奇才,連股神巴菲特、富達公司副主席彼得.林區、橋水基金創始人雷.達里歐、交易界的麥可.喬丹史蒂文.寇恩,乃至名列美國400富豪榜內的喬治.索羅斯,都難以企及。而他究竟如何作到的?也是眾人一直感到好奇的疑問。

西蒙斯在MIT與哈佛大學,身為當代頂尖的數學家,甚至幫助美國政府解密蘇聯的密碼。但其後西蒙斯突然放下原有的成功人生,投向金融界,帶來震撼彈。他聘請數學家、物理學家、電腦工程師,幾乎從不雇用華爾街的分析師,花費多時蒐集市場變遷的數據,找到市場機制的原理,建立數學決策模型。他創立的文藝復興科技公司至今所創下的收益達1,000億美金,旗下的大獎章基金從1988年便從未虧本過,平均年化回報率達34%,而西蒙斯本身的身價更是高達230億美金,名列美國400富豪排行榜蒂21名。徹底改寫金融世界的運作,成為所有公司效法的範例。

在文藝復興科技基金成為市場鉅頭後,西蒙斯不戀足於商界,開始往科學研究、教育和政治界發展。然而,2016美國總統大選卻未能如支持西蒙斯的願,諷刺的是,多虧了西蒙斯所創辦的文藝復興科技基金公司聯席執行長羅伯特.默澀,川普才得以當選,其除了實際金援川普外,亦指派史蒂芬.班農為競選顧問,無疑讓川普如有神助,而英國脫歐的背後,默澀也參與其中。

在探訪多名西蒙斯現任及離職員工後,佐克曼為我們撰述了全球頂尖數學家暨打破商界獲利記錄奇才──西蒙斯與的文藝復興科技基金的發展起落,是金融發展史上關鍵的精彩故事。(文/博客來編譯)

【2019金融時報與商業書大獎─決選入圍】

身價達200億美金 股神巴菲特都望塵莫及

金融界傳奇人物,顛覆華爾街的數學家詹姆斯.西蒙斯

致富祕辛與人生起落 由資深華爾街調查記者古格里.佐克曼Gregory Zuckerman告訴你

無庸置疑,詹姆斯.西蒙斯James (Jim) Simons可以說是當代致富奇才,連股神巴菲特、富達公司副主席彼得.林區、橋水基金創始人雷.達里歐、交易界的麥可.喬丹史蒂文.寇恩,乃至名列美國400富豪榜內的喬治.索羅斯,都難以企及。而他究竟如何作到的?也是眾人一直感到好奇的疑問。

西蒙斯在MIT與哈佛大學,身為當代頂尖的數學家,甚至幫助美國政府解密蘇聯的密碼。但其後西蒙斯突然放下原有的成功人生,投向金融界,帶來震撼彈。他聘請數學家、物理學家、電腦工程師,幾乎從不雇用華爾街的分析師,花費多時蒐集市場變遷的數據,找到市場機制的原理,建立數學決策模型。他創立的文藝復興科技公司至今所創下的收益達1,000億美金,旗下的大獎章基金從1988年便從未虧本過,平均年化回報率達34%,而西蒙斯本身的身價更是高達230億美金,名列美國400富豪排行榜蒂21名。徹底改寫金融世界的運作,成為所有公司效法的範例。

在文藝復興科技基金成為市場鉅頭後,西蒙斯不戀足於商界,開始往科學研究、教育和政治界發展。然而,2016美國總統大選卻未能如支持西蒙斯的願,諷刺的是,多虧了西蒙斯所創辦的文藝復興科技基金公司聯席執行長羅伯特.默澀,川普才得以當選,其除了實際金援川普外,亦指派史蒂芬.班農為競選顧問,無疑讓川普如有神助,而英國脫歐的背後,默澀也參與其中。

在探訪多名西蒙斯現任及離職員工後,佐克曼為我們撰述了全球頂尖數學家暨打破商界獲利記錄奇才──西蒙斯與的文藝復興科技基金的發展起落,是金融發展史上關鍵的精彩故事。(文/博客來編譯)

Shortlisted for the 2019 Financial Times and McKinsey Business Book of the Year Award

Bestselling author and veteran Wall Street Journal reporter Gregory Zuckerman answers the question investors have been asking for decades: How did Jim Simons do it?

Jim Simons is the greatest money maker in modern financial history. His track record bests those of legendary investors including Warren Buffett, Peter Lynch, Ray Dalio, and George Soros. Yet Simons and his strategies are shrouded in mystery. Wall Street insiders have long craved a view into Simons’s singular mind, as well as the definitive account of how his secretive hedge fund, Renaissance Technologies, came to dominate financial markets. Bestselling author and Wall Street Journal reporter Gregory Zuckerman delivers the goods.

After a legendary career as a mathematician at MIT and Harvard, and a stint breaking Soviet code for the U.S. government, Simons set out to conquer financial markets with a radical approach. He hired mathematicians, physicists, and computer scientists, most of whom knew little about finance. Experts scoffed as Simons built Renaissance Technologies from a dreary Long Island strip mall. He amassed piles of data and developed algorithms to hunt for deeply hidden patterns in the numbers—patterns that reveal rules governing all markets.

Simons and his colleagues became some of the richest individuals in the world and their data-driven approach launched a quantitative revolution on Wall Street. They also anticipated dramatic shifts in society. Eventually, governments, sports teams, hospitals, and businesses in almost every industry embraced Simons’s methods.

Simons and his team used their newfound wealth to upend society. Simons has become a major influence in scientific research, education, and politics, while senior executive Robert Mercer is more responsible than anyone else for Donald Trump’s victorious presidential campaign. The Renaissance team’s models didn’t prepare executives for the ensuing backlash.

The Man Who Solved the Market is the dramatic story of how Jim Simons and a group of unlikely mathematicians remade Wall Street and transformed the world.

天天爆殺

天天爆殺  今日66折

今日66折

博客來

博客來 博客來

博客來 博客來

博客來 博客來

博客來 博客來

博客來